Why GP Stakes?

A larger number of diverse investors are allocating to GP stakes due to increasing familiarity with the asset class, the strategy’s cross-cycle track record and a heightened focus on DPI.

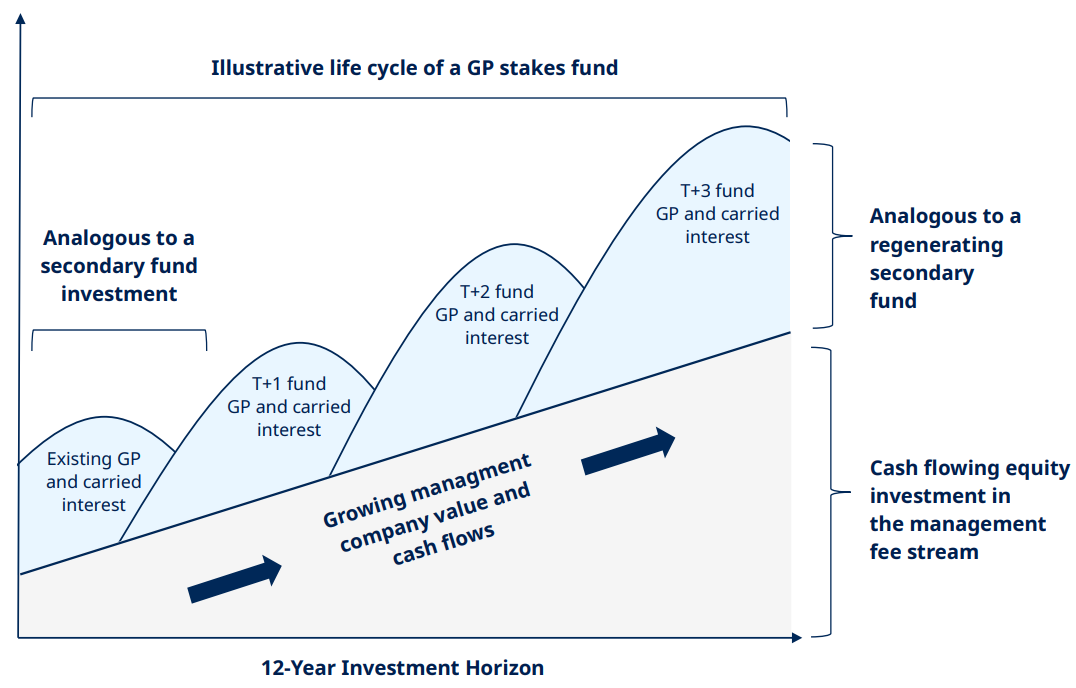

Investors who are less familiar with the strategy often ask how they should classify GP stakes within their portfolios and what the closest comparable investment might be.

Individual components of a GP stakes strategy have been likened to private equity, private credit and secondaries strategies, with these combined characteristics offering investors a differentiated returns profile that is arguably impossible to replicate in any other single investment.

The cash flow returns from a GP stakes investment, which come from management fees, carried interest and balance sheet returns, can be further bifurcated into (i) legacy cash flow from existing, in-the-ground funds and assets, and (ii) future cash flow from the GP’s continued fundraising and investment activity.

With larger, more established GPs who have numerous legacy funds and billions of dollars of in-the-ground assets, accrued carry exists that will convert to cash when harvested.

The ongoing nature of a GP stakes portfolio allows investors to build returns over a long-term horizon, compounding an even larger MOIC.

We believe a GP stakes investment can be viewed as the acquisition of recurring management fees, a continuously refreshing secondary position in the funds managed by the GP and upside potential from both carried interest and the potential realization of the equity value in the firm, should a minority position or the firm itself be sold over time.

The illustration has been provided for illustrative purposes only and takes into account certain assumptions which, if prove to not be true, may greatly affect potential outcomes. Furthermore, in no circumstances should this information be regarded as a representation, warranty, or prediction that an investment will achieve or is likely to achieve any particular result or that an investor will be able to avoid losses, including total loss of their investment. Inherent in any investment is the potential for loss. Source: Blue Owl